Your 65th birthday is coming up and you are looking forward to your retirement and enjoying your golden years. While you are busy planning for your big birthday, you also need to make sure that you are planning for your enrollment into Medicare.

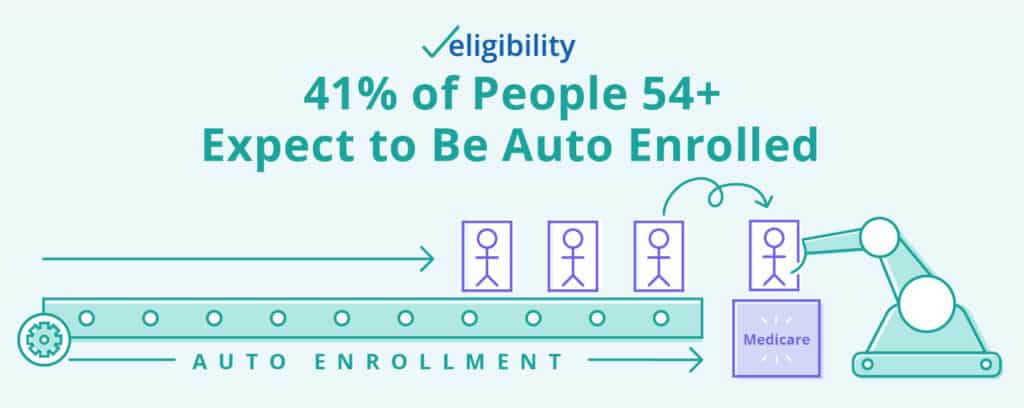

A recent survey found that 41% of people 54+ years old believe that they will automatically be enrolled in Medicare. Unfortunately, this isn’t true for most future Medicare beneficiaries and missing your enrollment period can result in late fees that can follow you for the rest of your life.

In order to avoid those late fees and any other troubles you might run into with Medicare, here is a quick breakdown of everything you need to know about Medicare enrollment.

Photo Cred Eligibility.com

Table of Contents

What is Medicare

First of all, let’s tackle what Medicare is. Medicare is government-funded health insurance for people 65 and older and for those with disabilities. It helps to pay for your medical needs such as hospital visits and medical equipment.

There are two different options when it comes to Medicare: Original Medicare and Medicare Advantage. Original Medicare includes Part A, which covers hospital insurance, and Part B, which covers medical insurance. You can pair Original Medicare with Medigap plans to cover other things you think you need. This option allows you to customize your plan specifically to you.

Medicare Advantage is more of a bundle option; you can search Medicare Advantage plans that are offered through private insurers and regulated by the government. Each plan contains different benefits. You can obtain dental and vision care, so you can find the bundle that provides the coverage you need.

When Should You Enroll in Medicare?

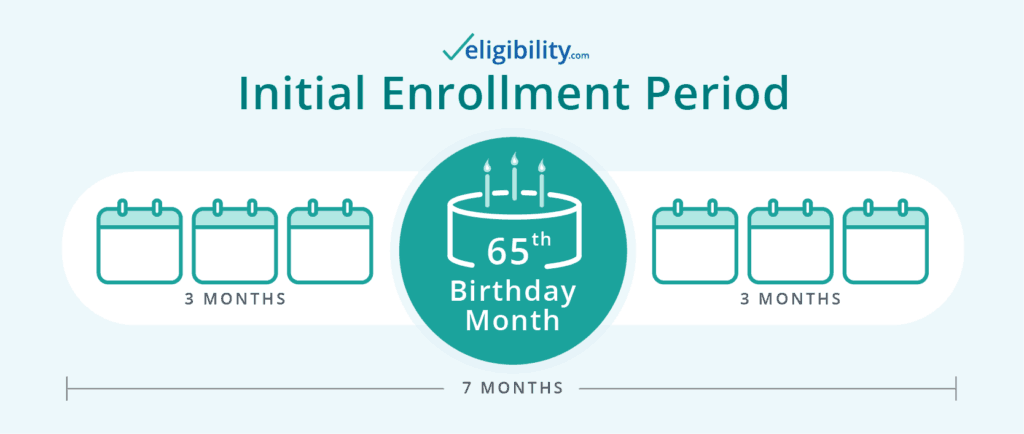

No matter what type of Medicare you decide to enroll in, it’s important that you enroll during your Initial Enrollment Period. While most people are familiar with the Open Enrollment Period that takes place during the fall, some may not know that if you miss your Initial Enrollment Period and wait until the fall you can rack up Late Enrollment Penalties.

Your Initial Enrollment Period takes place during the seven months around your 65th birthday. The enrollment period begins three months before your birthday month and goes until three months after your birthday month.

Photo Cred Eligibility.com

It is important to take the steps to enroll in Medicare because as stated earlier, you likely won’t be automatically enrolled. The only people who will automatically be enrolled in Medicare are:

- Those who have been collecting Social Security disability benefits for 24 months

- If you have ALS (Lou Gehrig’s disease) or ESRD (end-stage renal disease)

- Those who are already receiving Social Security before age 65

Unless you are included in one of these groups of people, it is critical to sign up during your Initial Enrollment Period in order to avoid late penalties.

Medicare Annual Enrollment Period

If the Initial Enrollment Period is when you are first signing up for Medicare, then what is the Annual Enrollment Period for? The AEP takes place every year during the fall. This year it goes from October 15 – December 7. It gives you the chance to review, change or add to your plan.

This is the time to examine your healthcare needs and whether your current Medicare coverage is enough. If you feel that you need more, then you can find over plans that you can switch to or you can add on to your current coverage.

If you are happy with your current plan, it is still important to do a little bit of research. You should be shopping around as plans and premiums change annually. For instance, your current plan may change. It may no longer cover a prescription that you need. It may be that your doctor may no longer be in your covered network. You don’t want to miss out on this important knowledge. You will want to go into the new year without the coverage that you need.

In order to stay on top of these changes, it’s important to do your research and to open all Medicare mail. Each year you will receive mail from Medicare. This will tell you whether your plan is discontinued next year or the Annual Notice of Change, which will state that your plan is available next year and show the changes that are happening to it.

Avoiding Medicare Scams During Open Enrollment

As you research and open all of your mail, you may notice that you are receiving offers or information that doesn’t fit with what you have read on the Medicare.gov site. This information could be from fraudsters who are trying to scam you out of your Medicare benefits or information.

Scammers take advantage of your Initial Enrollment Period and the Annual Enrollment Period to try and get misinformation out to seniors or to get their personal information. There are a few ways that scammers may try to take advantage of your Medicare benefits and a few things you can do to avoid getting scammed.

One of the most popular Medicare scams is when someone calls you from a number that seems official and says that they are from Medicare. This person will then ask you for your Medicare number. Never give your Medicare number to someone who calls you. One of the most important things to know when avoiding Medicare scams is that Medicare will never call you and ask for your Medicare number. Typically, information from Medicare is shared through the mail. If you receive a call from someone claiming to be from Medicare, they are likely a fraudster.

If you do receive a call from someone claiming to be from Medicare or Social Security, hang up and then find the organization’s main number and call them. Once you have called the actual organization, you can ask if they are trying to get a hold of you.

Stay informed about current trends in Medicare scams so you can be alert and ready to combat any attempts to scam you from your Medicare information.

Conclusion

Your golden years can be some of your best as you enjoy retirement and spending time with friends and loved ones. Get the healthcare coverage and benefits you need and deserve through Medicare. Make sure you are enrolling during your Initial Enrollment Period and stay up-to-date on your coverage with each AEP.

Guest post provided by Kendra Leak @ Eligibility.com

Be sure to check out our other Health and Wellness Articles!

These statements have not been evaluated by the Food and Drug Administration. Any product(s) on this website is not intended to diagnose, treat, cure, or prevent any disease.

Always consult a licensed health care professional before starting any supplement or nutraceutical. Especially if you are pregnant or have any pre-existing medical conditions. Individual results may vary. These are from my own experience and the experience of others and only our opinions.

72 responses to “Enrolling in Medicare – Avoiding Scams”

This is a great post. In my field, I see too many people being taken advantage of when it comes to Medicare because they don’t understand it. A great resource is local senior centers and senior resource centers for understanding Medicare. There are seven different Medicare programs.

Thanks Pauline! I am glad to see a pro’s opinion on this matter!

Awesome info! I’m still a few years away from 65 but it’s good to know about all of this.

Retirement takes planning!

Thanks for the tips. I’m not quite there yet [sigh] but it is coming on quick.

I hear you! I have a while but my husband is getting close!

I’m years away from this, but my parents aren’t and this is great info to know and pass on. Thanks!

Thanks Christina! I hope this helps!

It’s awful to acknowledge, but there are so many scammers out there. Knowing how to properly enroll can be a huge prevention for avoiding those who would take advantage of the elderly.

Absolutely! Thank you!

Thank you for explaining this. Even if you aren’t at the age of retirement this info is needed

Yes! Many help their parents with this and need the info as well.

I didn’t realize that enrollment wasn’t automatic… it really should be!

You would think! But just like Social Security, you must take steps to get it.

I’m not there yet but this is such great information for those who are!

Absolutely! Thanks, Judean!

This is a perfect step by step for Medicare enrollment! I ended up reading the article about emotional abuse at work as it was ultimately the reason I left my hospital job last January. Spot on!

Awesome Jeanette! I am glad we can be a resource for you!

Sounds complicated, glad that this isn’t something I have to sort out as a Canadian!

I guess not! Yes, many of the US processes and systems are complicated compared to Canada.

Excellent article and breakdown of the Medicare enrollment steps. Thank you for taking the time and for sharing.

Thank you Lisa!

Great article! Love all the information. Will have to save it as I’m headed in that direction!!

Thanks, Jen! Glad it was a resource for you!

I’m not at this point yet, but I do have family that is, so I will have to send them here with any questions!

Awesome! I hope it helps!

So glad I came across this today! I totally forgot to do open enrollment until now! Thanks!

Fantastic! Glad you made it!

Thank you for sharing important information!

You are very welcome!

This is such a helpful article. I think I fall into that category of thinking that I would automatically be signed up. Thank you for sharing!

I am glad we could clear it up! Thanks!

I’ve looked at medicare before and it’s always scared me because I wasn’t sure how to go about it, or what to avoid. Your post is perfect for all of these issues, so thank you 🙂

Awesome Kristen! Glad we could help!

Great info! It’s so sad that people try to scam the Medicare System.

Yes! So many seniors fall prey to scammers.

Great information and much needed. I’m sure this will be super helpful for people.

Thank you Rachel!

A great resource for those approaching those years! Wish I had this a few years ago when I was helping my Mom enroll.

Yes! Many are helping their parents with this info!

Thank you for the information. I won’t’ be using this anytime soon, but I am glad that I have some info that I can impart to my customers. I have a lot of older customers who I know I could pass this along too. Thank you.

Fantastic! I hope it helps!

With retirement not that far away, this was good information, especially about enrollment.

Awesome Karen! Glad we could help!

With retirement not that far away, this is good information to know especially about enrollment. Thank you.

I am so glad it was useful!

Such a well written post! Thanks for the information!

Thanks Tara! We hope it helps!

This is a great post. I would have never know unless my Aunt told me. I thought it was so interested that you had to enroll earlier.

Thanks Lisa!

This post is very informative. I am going to soon start working for Presbyterian as a care coordinator. I’ll have to bookmark this post because I might need to share it with clients. Thank you!

Awesome Brianna! Glad it can be a resource!

So many scammers out there! For those entering into Medicare, don’t forget to get your first annual wellness visit done as well! Sets you on the right track for keeping yourself healthy. 🙂

Great information!!

Great advice Michelle! Thanks!

Great post!! SO important to understand the in and outs of Medicare and the benefits of this information is so important!

Yes! It can be overwhelming!

Very informative post! I know how benefits can be really confusing for people to figure out on their own.

Yes! Thank you so much Jill!

I LOVE ALL OF THIS! As a nurse practitioner I see time and time again patients who “picked the wrong plan” or that grandpa “bought something he shouldn’t have”. Thanks for the info and for keeping this dialogue going! So important!

Oh, I am so glad you liked it! Coming from a medical professional that means a lot!

This is good advice. It seems like there are so many scams going around. I just found out last week that I didn’t need to enroll in Medicare since I am already receiving SSDI. Now I have to figure out part B. Thanks for the reminder to make an appointment with the Social Security office and maybe my insurance agent to figure all of this out.

There are some great plans out there. There is a lot of information to get through!

We are closing in on this and I have been starting to research this! Thanks for the information!

Awesome! I think the website is a great resource!

This is a good resource for people preparing for retirement. It’s important to know what you’re getting into when it comes to healthcare. It can be confusing and complicated, but it is soooo vital that we get it right! Great post!

Absolutely! And thank you so much!

I definitely was one of those people that thought I didn’t have to do anything to enroll… thanks for this informative article!

Awesome! I am glad this helped!

I always get confused with this subject. Thank you for breaking it down in this easy to understand way!

That is great! I am glad it was a resource for you!

This is a wonderful post with specific detailed information! I always get so confused with these kinds of things – thanks for breaking down in an easy to understand way!

Fantastic! Thank you!